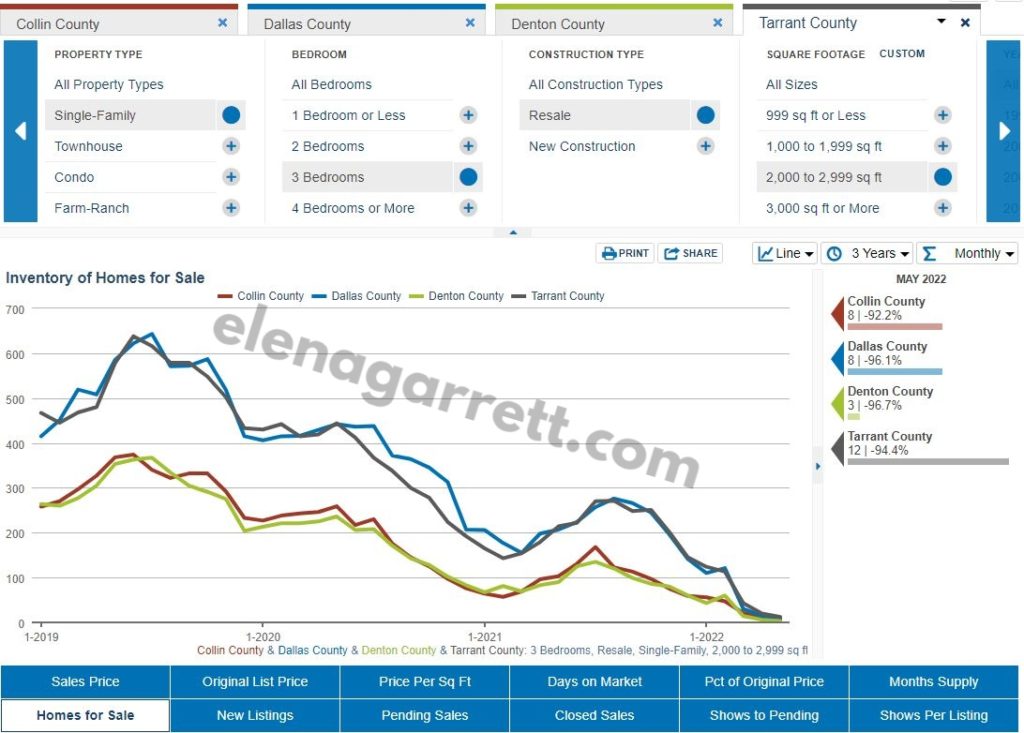

June 2022: Impact of Higher Interest Rates on Home Sales

June 29, 2022

June 28, 2022

Let’s take a brief look at the changes that the DFW market is experiencing, or is likely to experience soon, due to changing economic conditions.

The number of mortgage applications is declining

Therefore the number of home shoppers is declining as well, leading to lower competition among buyers.

The market is shifting from “overheated” to warm

As the stats show here, in May 2022 the sellers had to keep their property on the market longer, and they sold their homes at less aggressive prices than just a few months ago. The home shoppers were bidding less cash above the asking price as they sensed less competition due to fewer people looking at properties.

Home shoppers are making more conservative offers

Many shoppers are still viewing properties, but they are waiting to see if the “market is about to crash” and not making offers. When they do bid, they do not offer as much as they would have offered in the past, as they sense the changing economical environment

Lenders are reducing the home shoppers’ approved budget

Increased interest rates make the buyers’ future mortgage payments go up by hundreds of dollars per month. The interest rates plus the overall increased cost of living puts shoppers in a situation where they are forced to submit lower offers on homes in order to be realistic with their budgets.

Supply of new construction homes may decrease

Higher interest rates will hurt the builders more because the builders have to pay higher prices for their supplies, labor, and cost of lending. Also, due to ongoing operational costs, the builders may have less flexibility in lowering their prices than the sellers of existing homes. This may lead to builders deciding to build fewer units this year, reducing the supply of available homes

Supply of pre-owned homes is not likely to increase sharply

Many homeowners who planned to upgrade to a larger home this summer may find themselves unable to buy their next home due to the overall shifting economy and their lenders approving them for smaller homes than they hoped for. Those homeowners might hold off on selling their current home, reducing the supply of available homes even further

Home shoppers moving to DFW from other states may help to keep the market “warm”

The DFW region is experiencing unprecedented migration of people relocating from other states. As those shoppers are very likely to sell their homes in other states and have a significant amount of cash on hand, they will be less affected by the interest rate increase. They could help to continue to absorb the existing inventory of “move-in ready” homes and keep the market from cooling even further.

Investor-buyers may become less aggressive with purchasing homes

Higher interest rates might cause investor-buyers to put the breaks on their purchasing activities to “wait and see” how the housing and rental markets adjust to the new economic realities. Instead of writing high offers on all homes indiscriminately, the investors may shift back to their preferred strategies of looking for homeowners who are desperate to sell and who are ready to sell at a much lower price than the house would normally be worth.

Rents are likely to go up

A significant percentage of renters will decide to postpone buying this year and continue to rent (thus reducing the supply of homes available for rent). At the same time, the landlords will feel compelled to increase their cash flows in order to combat higher taxes, higher insurance costs, higher costs of borrowing (if they used an adjustable-rate mortgage to buy the rental), and higher costs of labor and materials to maintain/renovate/repair properties. All of this may lead to the rent prices rising despite the economic cooldown.

72sold advertising opportunities blog buy4cash Canadian citizens cash offers dfw housing market update events financial fitness for buyers for homeowners for investors for renters for sellers holidays houses industry news international home buyers itin knowledge articles legal and financial market updates monthly updates mortgage moving to Texas owner financed houses rent-to-own seller financed houses selling as-is special program stats stats and trends taxes tips and tricks videos videos for home buyers videos for investors videos for sellers