DFW Home Sellers’ Guide for 2024: Mastering the Market in an Election Year

December 23, 2023

By Elena Garrett, December 20, 2023

1. Market Overview and Pricing Trends with Interest Rate Projections

The DFW housing market in 2024 is expected to exhibit a blend of stability and uncertainty, especially in the context of the upcoming election year. While the average sales price for single family homes rose slightly year-over-year in 2023, this stability is contrasted by a varied landscape across different housing types and locations within the metroplex. Sellers should be prepared for these mixed signals, where certain areas might witness a surge in demand and pricing, while others may experience stagnation or decline. Monitoring these trends closely will be crucial for sellers to maximize their profits.

Moreover, the pricing trends within the DFW market will be influenced by broader economic factors such as interest rates, employment rates, and the overall health of the national economy. A decrease in interest rates typically encourages more buyers to enter the market, which could lead to shorter listing periods and potentially higher selling prices. But the political changes and policy decisions that often accompany election years could introduce new variables. It’s essential for sellers to stay informed about the changing housing market trends and perhaps consult with real estate experts to understand the best timing for selling or renting their properties.

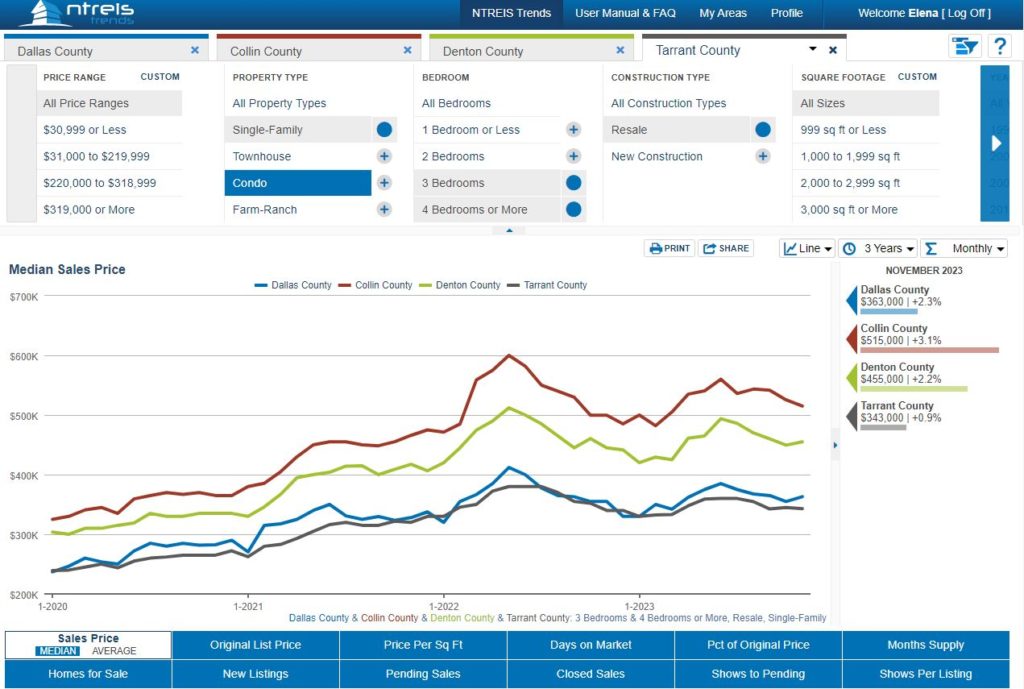

Home sale prices in the Dallas, Collin, Denton, and Tarrant counties

2. Inventory Levels, Buyer Demand, and Political Climate in Light of Interest Rate Changes

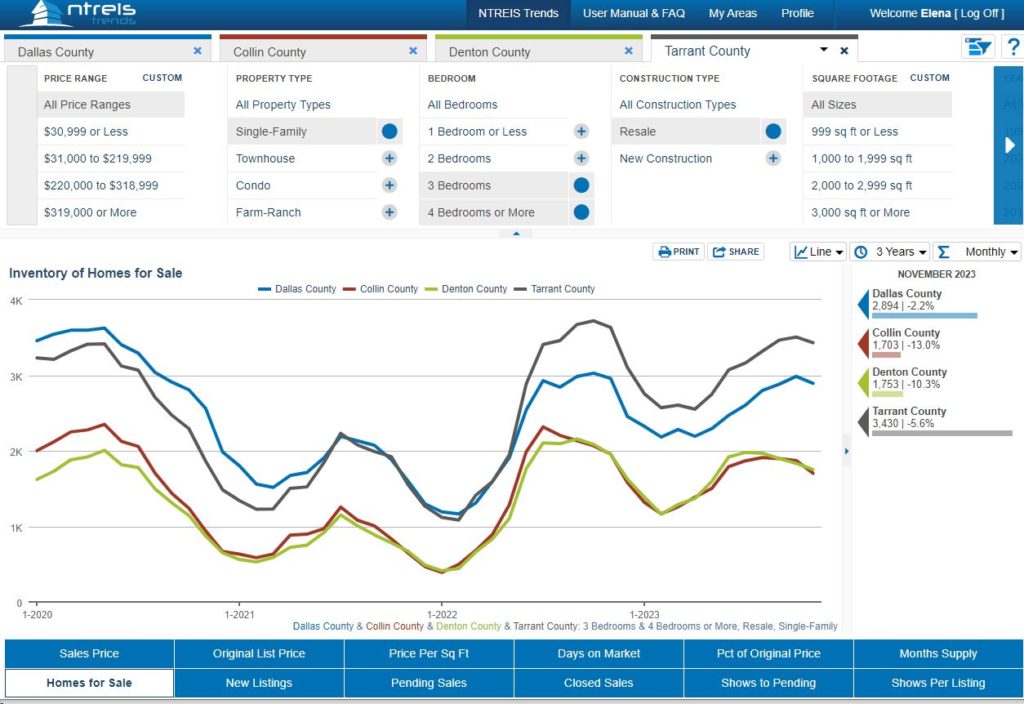

The inventory levels and buyer demand in the DFW area in 2024 are expected to be significantly influenced by the projected decrease in interest rates. The interest level changes could lead to an increase in housing inventory due to new constructions and developments, affecting the supply-demand balance and potentially impacting pricing strategies and sale timelines for sellers.

In terms of buyer demand, the DFW area’s strong economic growth continues to attract a diverse population seeking housing. The lower interest rates could further fuel this demand, providing sellers with a larger pool of potential buyers. However, the uncertainties of an election year, where political outcomes and policy changes could sway public sentiment and economic outlooks, should be a key consideration for sellers.

Lastly, the political atmosphere in 2024, being an election year, is likely to add a layer of uncertainty to the real estate market. Policy changes, especially those related to taxation, housing regulations, and economic stimulus, could significantly influence buyer behavior. Sellers should consider these potential changes and strategize accordingly, possibly favoring early-year listings to capitalize on current market conditions before any major shifts occur.

3. Future Predictions, Market Stability, and Election Year Considerations with Interest Rate Dynamics

Looking ahead to 2024, the DFW real estate market remains cautiously optimistic. The region’s strong economic fundamentals support market stability, and the expected decrease in interest rates could create a favorable environment for sellers. However, the unpredictability of the election year adds a layer of complexity to these predictions.

The decrease in interest rates is likely to lead to an increase in buyer demand, which could result in a more dynamic and competitive market for sellers. This scenario may present opportunities for sellers to achieve higher sale prices, especially if they list their properties early in the year before any potential political upheavals.

In conclusion, while the projected decrease in interest rates could lead to a buoyant housing market in DFW, sellers should remain vigilant and responsive to both the market and political changes. Consulting with real estate professionals to navigate these dynamics will be essential for successfully selling properties in this complex market environment.

Conclusion

The fluctuating trends that we are observing now and that would likely persist in 2024, influenced by an election year’s unpredictability, have the potential to make the market landscape even more intricate than usual. If you’re considering selling your home in this dynamic market, a conversation with a realtor could be your first step towards a well-informed strategy. It’s not just about making a sale; it’s about making the right sale at the right time. Feel free to reach out to a local real estate expert who can guide you through the intricacies of the 2024 market, ensuring your decisions are as sound as they are successful.

#DFWRealEstate2024 #DallasFortWorthHousing #HomeBuyingTips2024 #DFWRealEstateForecast #DallasRealEstateInsights #FortWorthHousingTrends #2024PropertyMarketDFW #RealEstateAdviceDFW #DFWHomeBuyersGuide #TexasRealEstate2024

2024: A Home Buyer Preview into the DFW Home Market Dynamics

- 10 Questions Every Home Seller Should Ask of Their Agent

- Selling Your Home? The Hidden Costs of Choosing the Wrong Method!

- North Texas Real Estate: 2024 Home Market in Review

- 关于对《声明》第五条第2和第3节的拟议修改的说明

- HOA Change of HOA Declaration and Insurance Coverage – 2025

72sold advertising opportunities blog buy4cash Canadian citizens cash offers dfw housing market update events financial fitness for buyers for homeowners for investors for renters for sellers holidays houses industry news international home buyers itin knowledge articles legal and financial market updates monthly updates mortgage moving to Texas owner financed houses rent-to-own seller financed houses selling as-is special program stats stats and trends taxes tips and tricks videos videos for home buyers videos for investors videos for sellers