Do not sign another lease until you read this: The hidden costs of renting

September 9, 2022

Upfront costs of renting

- Application-related fees (including credit report and background check fees, one-time set up fees, etc)

- Deposits (rent deposits, utility deposits, pet deposits)

- Rent payments

- Yearly rent increases (with no added benefit to you)

- Pet rent (in some cases)

- Small repairs that you do on your own dime

- Lawn service and other items your rent requires you to pay for

- Renter insurance

- Moving truck and packing costs (much more frequent than for buyers)

- Moving out costs (small repairs, changing schools, giving up furniture and appliances that you do not want to move, hotel stays, etc)

- Cleaning costs (when you move out (and, sometimes, when you move in)

- Storage fees (in-between rentals or sometimes if your rental is too small to fit all your stuff)

- Risk of eviction and extra fees if the landlord is a difficult landlord

- Countless hours spent on the phone requesting repairs from the landlord

- Countless hours spent on looking for new rentals, filling out applications, moving, settling in, etc

Those costs tend to be systematic and increase (compound) with every year the family is renting.

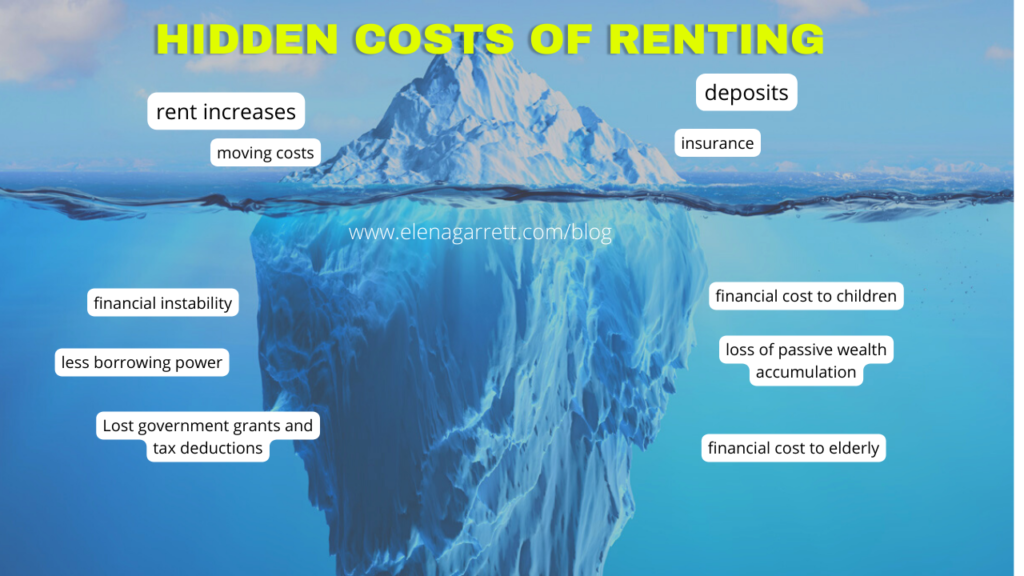

But those are obvious costs that are easy to see and calculate. There are also a number of hidden and delayed costs that are much harder to estimate in a spreadsheet, but that over time can compound to become very noticeable and detrimental to the family’s financial growth.

What about the hidden costs?

Hidden financial costs of renting

Lack of automated wealth growth via home value appreciation

Because the renters do not participate in passive wealth accumulation from home values, their net worth (assets minus liabilities) tends to stay, on average, very flat, as they accumulate almost no assets (like real estate, stocks, bonds, etc) but their liabilities (like buying cars for their teenagers, opening credit cards to buy child supplies, medical expenses, etc) often grow over years.

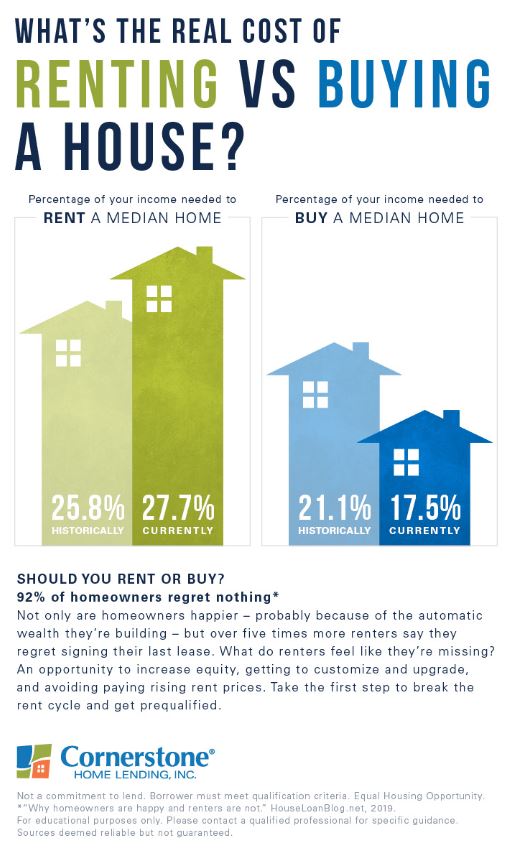

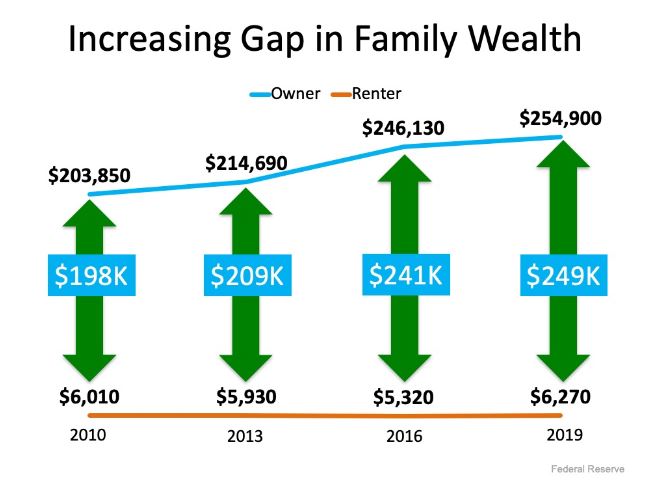

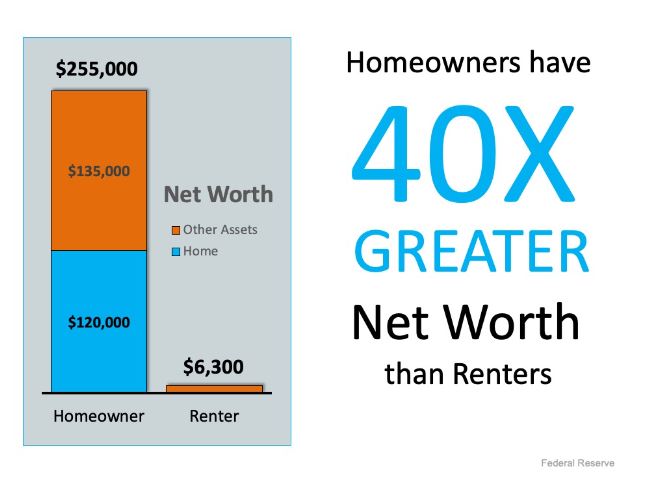

Based on the nationwide data from Federal Reserve, the average difference between a homeowner and a renter was $249,000 in 2019 (this is the latest data I currently have).

Lack of ability to borrow against home equity

As the renters live in the house, the house value (the price it could sell for) continues to slowly grow. But if the renter needs a short-term loan (for example, to pay for a new car, for kids’ education, to start a business and to buy supplies, or to pay off a medical expense), they cannot request a loan against the increased value of the house.

As the homeowners live in the house, they have the ability to borrow against the accumulated value (equity) to pay bills, invest, or manage unexpected cash flow crises.

Loss of government grants and tax deductions

Renters do not have access to government grants (sometimes in tens of thousands of dollars) that are available to first-time buyers borrowing with FHA loans. Those grants would be equal to missing out on a $10,000 or $15,000 check from the government that renters did NOT receive.

Also, homeowners are eligible for up to 13 tax deductions that the renters do not have access to. First-time homeowners may also be eligible for an ADDITIONAL $15,000 in tax credits in 2022 as signed into law by the Biden administration.

So, two families living on the same street in similar homes could see a DRASTIC difference in their taxes owed (or the amount of the tax rebate that they get) based on whether they are homeowners or renters.

Financial costs to children

Parents who own their homes can not only use the home value increases to help their children to have a more trouble-free start in education or business, but they can also create generational wealth by using the formula described in Elena’s webinar “From Renter to Home Owner to Investor” to gift their children with wealth-building habits and income-producing properties when the children reach adulthood.

Parents who are renting are less likely to have those options. Therefore, they are less likely to have the ability to use the increases in home value in order to help their children with higher education, down payments on their children’s first homes, or help to support their children’s investments and business ventures. They are also less likely to have significant assets like rental properties to transfer to their kids.

Financial costs to the elderly

As people age, their income tends to drop while their medical expenses tend to increase. This is when elderly renters tend to experience the most hardship, as with each passing year the rents tend to increase while their income is dropping.

The homeowners, on the other hand, typically have their mortgage paid off by the time they reach retirement age, and therefore their housing expenses go to nearly zero (although they will still pay taxes and insurance). Even more importantly, if homeowners above 62 years of age are faced with financial hardship, they can take a reverse mortgage on their home in order to obtain a monthly income supplement from their home.

Financial costs to long-term financial well-being and generational wealth

Being a renter means sacrificing your hard-earned income to make someone else more wealthy, pay someone else’s mortgage costs, and improve the lives of someone else’s children.

The long-term effects on the family’s downline are significant.

Homeownership tends to be the catalyst many families experience to start having more money left over at the end of the month to start setting money aside into the rainy day funds, educational funds, retirement funds, real estate investments, and more. They also have easier access to loans (most lenders are HAPPY to lend to people with large assets).

Renters, on the other hand, tend to spend more and more on housing every year, leaving them with fewer options for savings, rainy funds, and investments.

Take a look at the Federal Reserve data above. That data serves as a wake-up call for many families who are trying to increase their net worth while renting.

If you would like to have more information on the topic of growing your family’s generational wealth through home ownership, make sure to watch Elena’s webinar, “From Renter to Home Owner to Investor”

72sold advertising opportunities blog buy4cash Canadian citizens cash offers dfw housing market update events financial fitness for buyers for homeowners for investors for renters for sellers holidays houses industry news international home buyers itin knowledge articles legal and financial market updates monthly updates mortgage moving to Texas owner financed houses rent-to-own seller financed houses selling as-is special program stats stats and trends taxes tips and tricks videos videos for home buyers videos for investors videos for sellers

- 10 Questions Every Home Seller Should Ask of Their Agent

- Selling Your Home? The Hidden Costs of Choosing the Wrong Method!

- North Texas Real Estate: 2024 Home Market in Review

- 关于对《声明》第五条第2和第3节的拟议修改的说明

- HOA Change of HOA Declaration and Insurance Coverage – 2025