July 2024 DFW Home Market Update

July 3, 2024

July 2, 2024- by Elena Garrett, Realtor, and 72Sold Area Director

Check out below the trends that the home market data is showing for the 4 main counties in the DFW area: Dallas County, Collin County, Tarrant County, and Denton County.

ELENA’S PREDICTIONS FOR THE NEXT 4-6 MONTHS:

Despite still-elevated interest rates, the sale trends in 2024 are currently repeating the traditional “Spring-Summer” price fluctuation of the previous year.

The last good opportunity to sell at the highest profit in the Summer-Fall is likely going to be July due to potentially unpredictable impact of the Realtor commission lawsuit that is guaranteed to add more chaos and uncertainty to the already-unsettled current home market, not to mention the potential national and international Black Swan events that may appear closer to the conclusion of the Election Campaign this year.

The best time to buy the house in 2024 will be will also be in July, due to the same lawsuit and the same potential issues that the election environment might bring unexpectedly.

Although the Fed keeps promising the drop the interest rates (and keeps breaking these promises), given the overall landscape of uncertainty and unfolding legal changes with the buyers’ agents, after August (once the kids return to school), we would expect a pretty steep decline in prices for the rest of the year.

RECOMMENDATIONS:

Home sellers who are trying to sell this year are advised to keep in mind that still-high interest rates mean that the shoppers are currently in the bargain-hunting mood. If your home needs repairs and updates, instead of pricing high and incurring long days on the market and potentially price cuts, you can attract bargain-shopping buyers by offering incentives such as interest-rate buydowns and cash concessions. If at all possible, I would recommend that home sellers who are looking to get the highest amount for their property in the remaining part of the year to consider timing the market and selling in July at the latest, and use a program like 72Sold to make sure that their home sells within the first 2-3 days of being on the market.

Homes that are NOT sold within the first week are more likely to be targeted by bargain shoppers who will expect the sellers to provide cash concessions to the buyers.

Home buyers who are trying to buy in this year will have additional hurdles to overcome as the Realtors who typically represent buyers may now ask the buyers to guarantee payment of their commission, adding another huge expense to the already high cost of buying a home or shop for homes without the advice of an experienced professional.

As the interest rates remain close to 6%-7%APR, we recommend that home buyers who plan to use a home loan ask their lender for information on how to buy down the interest rates, temporarily or permanently. For home buyers on a tight budget, consider looking at homes that have been on the market for over 60 days, as those homes are more likely to provide price concessions or funds to help the buyers with the interest rate buydowns.

To the home sellers: we recommend seriously looking into the 72Sold home selling program which is designed to sell nearly any home within the first 72 hours of it being on the market – and, typically, at a higher price than competing homes. With the 72Sold approach, at the very least the home sellers will get the best chance to sell their homes at the top of today’s market and without having to do any price cuts or concessions.

DFW STATISTICS FOR JULY 2024

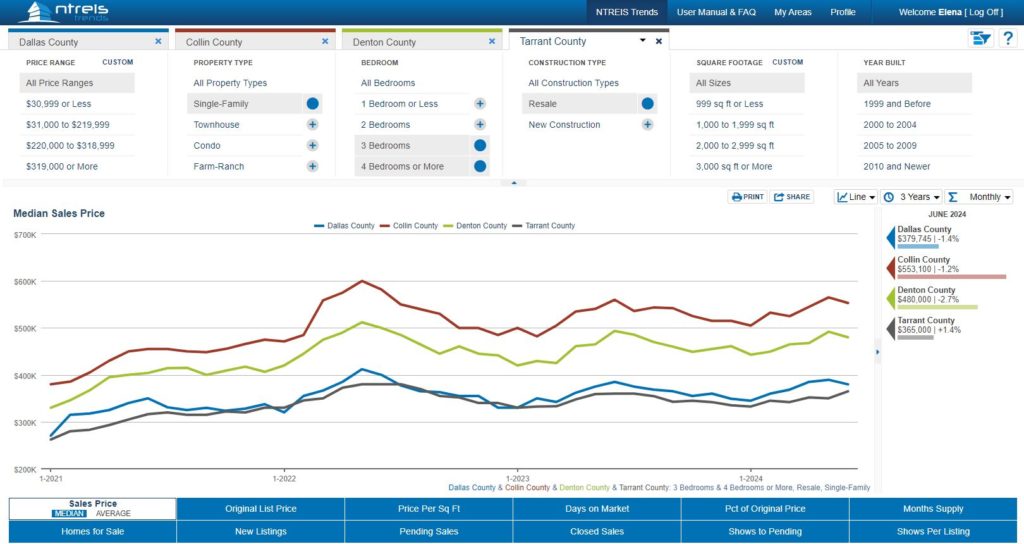

Home Prices Passed Their Summer Peak in May 2024

2024 started with a bang! Home prices in the DFW jumped on average in the early months of 2024. Average price point in Dallas county increased on average by $44,000 from January to May. Collin county prices increased by $60,000, Denton county prices increased by $49,000, and Tarrant county prices increased by $18,000 on average during that period.

But here comes the whimper. That Spring price bump did not last, with prices falling for all counties but Tarrant county after May. Dallas county homes lost on average $10,000, Collin county lost $12,000, Denton county lost $12,000 on average, and Tarrant county homes gained $6,000 in prices between May and June.

Please note that the prices reflect closing prices, which means that the contracts on those homes were written 2-4 weeks prioir.

We predict that home prices will continue to decline from their May peak as we head into August and the Fall months.

Most Homes Sell at About 98% of Asking Price

The graph below shows you how much in terms of percent of the asking price the house sold for. For example, “100%” means the house sold exactly for the same amount as the listing price. “110% SPLP” means the house sold higher than the listing price by 10%, while “90% SPLP” means the house sold for less than the listing price by 10%.

According to this graph, an average home seller ended up selling about at about 98.5% of their asking price in all counties. This is on average, of course, with some homes in the neighborhood selling quickly with multiple offers and others lingering on the market for months and suffering price reductions.

For home shoppers, this graph is good news. It demonstrates that their chances of getting home sellers to reduce their prices is there. For home sellers, this graph is bad news news because that shows that most homes are not getting multiple offers, and therefore some homes have to accept offers that are below their hoped-for price.

NOTE TO HOME SELLERS: The key to selling at or above the asking price is in the initial price of the house, not in the market conditions. Homes that we priced very competitively sell quickly and with multiple offers. Homes that are priced higher than they need to be tend to linger on the market and sell with price reductions.

Want to outperform the market and sell with multiple offers in any market? Review the 72Sold program elements that have to do with getting the buyers to pay more than they initially intended.

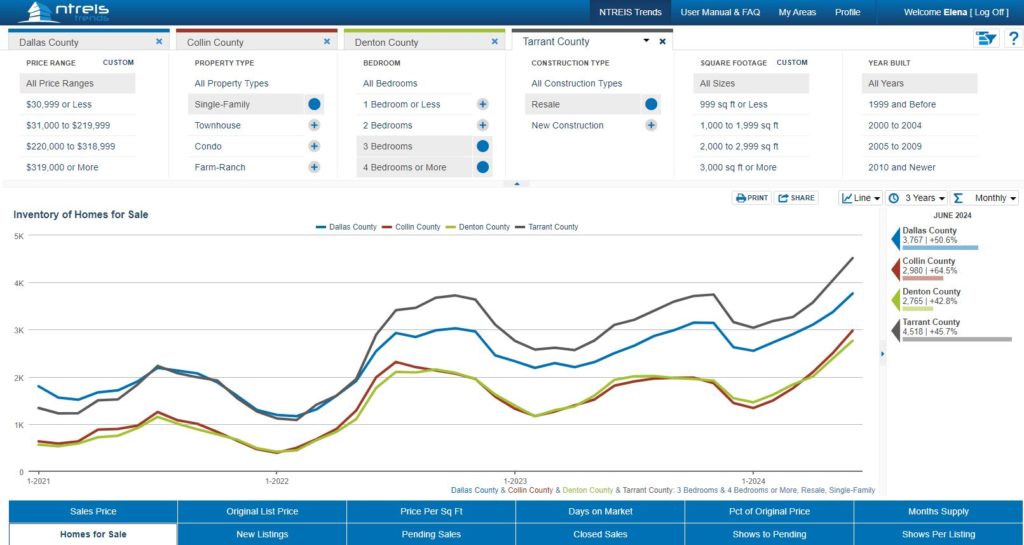

The DFW Home Market Inventory of Unsold Homes Is at Its Highest in Years

The inventory of unsold homes skyrocketed this year, with unsold properties accumulating on the market, creating more and more competition for buyer’s attention. This is an indication of a buyers’ market and potential trouble for the sellers as we head toward August and September.

The higher is the inventory (selection) of available homes, the more the market typically swings toward the buyers, and the more sellers have to compete with each other on price, improvements, and, potentially, monetary concessions to buy down interest rates or help the buyers with the downpayments.

We will continue to monitor the number of available homes to see how they affect home prices.

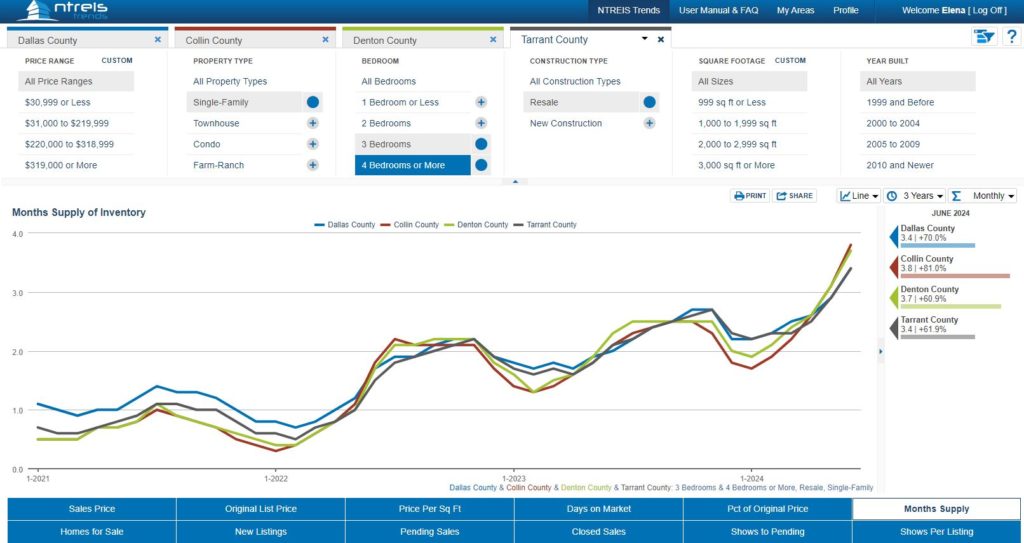

Months of Inventory

Months of inventory measurement is meant to determine how many months’ worth of purchasing activity could the area sustain if no new homes were listed for sale. Usually, any number below 4 months is supposed to indicate a seller market, any number above 4 months is supposed to indicate a buyer market.

As you can see, all four counties are showing nearly identical trends. The months of inventory indicator is currently at about 3.5 months of supply for all four counties, which means that the market is currently tilting in favor of buyers. The current 3.5 months of supply is one of the highest measurements of months of inventory the DFW area had in several years.

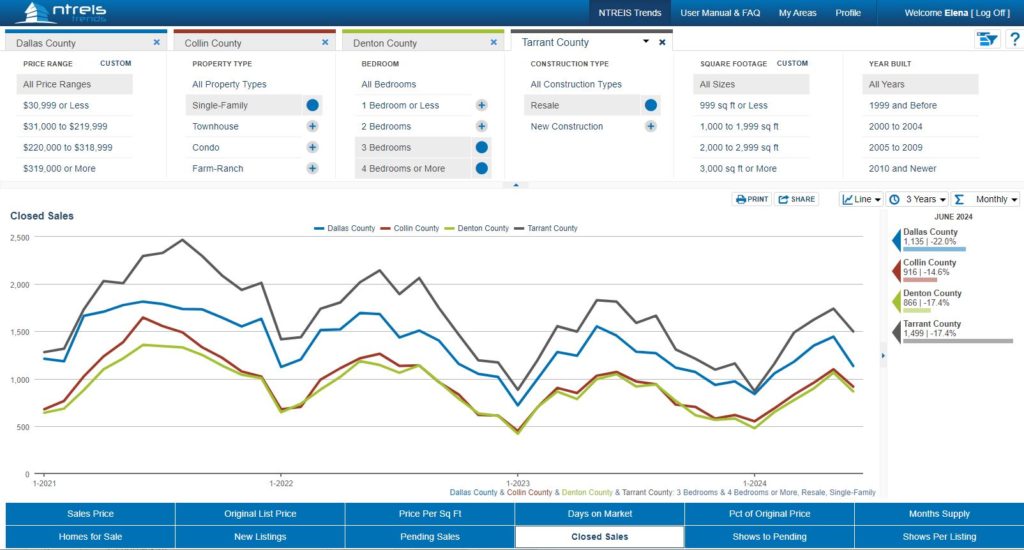

The DFW Demand for Homes is Following Normal Yearly Patterns

The number of homes sold (closed) in the DFW area peaked in May, which it typical for the DFW area and it follows a pattern we have seen in 2023 as well. The sale activity is driven by the buyer’s interest, and typically the buyer interest is at its highest levels right after the school is out in May.

Tarrant and Dallas counties are showing the most pronounced drops of closing activity, with Collin and Denton counties having a less noticeable decline. We can see that the same patterns were in play in the past few years.

We will continue to monitor the number of available homes to see how they affect home prices.

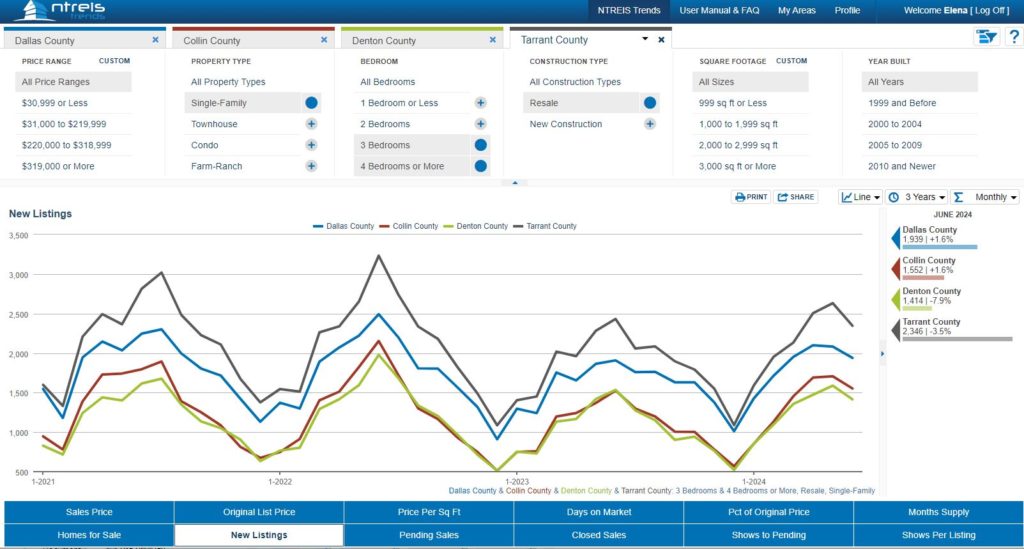

The Number of New Home Listings Peaked in May as Well

As expected, many sellers who could not sell waited for this month of May to put their homes back on the market again.

The overall number of new homes placed for sale in May was highest in Tarrant and Dallas counties, and lowest in Denton county. Similarly, Tarrant and Dallas counties showed the sharpest declines in new homes on the market in June, as if the inventory of new listings exhausted itself pretty quickly in those counties.

Days on the Market

Days on the Market is a measurement of how many days the average home takes to go under contract. Long days on the market typically show a slow, saturated, buyer-centric market where the supply exceeds demand. Short days on the market typically mean that the home buyers are buying aggressively, and it typically means that the demand is higher than the supply.

Currently, all 4 counties show that it takes 17 days on average to place a home under contract. This means that, despite the high inventory and dropping prices, the market still moves very quickly, and homes that were available last week may not be available next week, as other shoppers are snapping the available homes within 2-3 weeks of them being on the market.

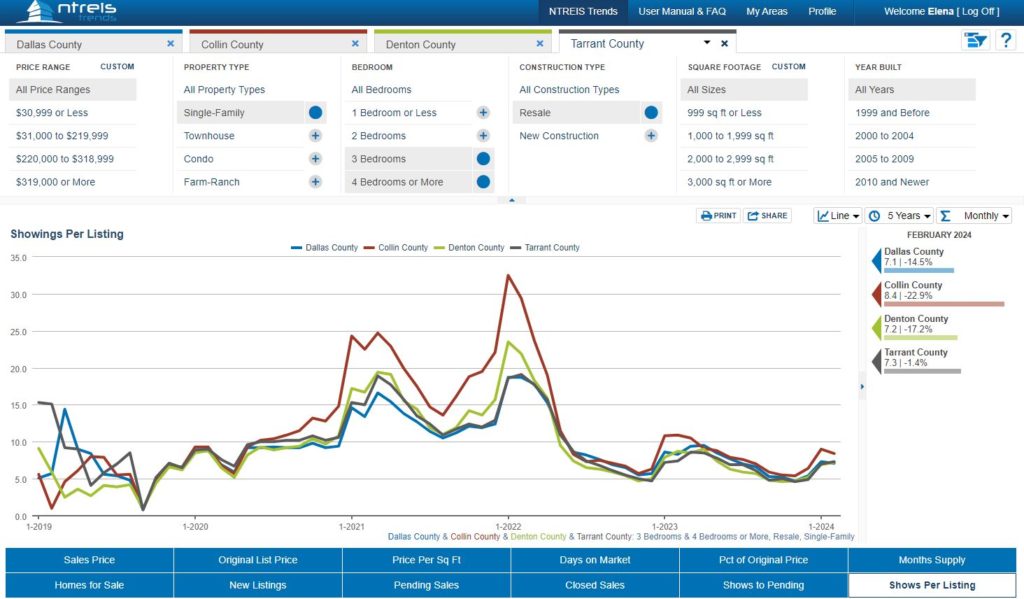

The Number of Buyers Looking at Homes Is Still Low

Speaking of “other home shoppers” (a.k.a competing buyers).

Based on the graph, an average home buyer should expect to compete with at least 7-8 other shoppers looking at the same home. This means that the number of motivated home shoppers has remained relatively flat throughout this year. This should serve as a caution to the home sellers not to price their homes too aggressively, as the shoppers are not experiencing a high-pressure sale environment overall, unless the seller is utilizing more advanced techniques to prompt home buyers to buy faster and at a (hopefully) higher price.

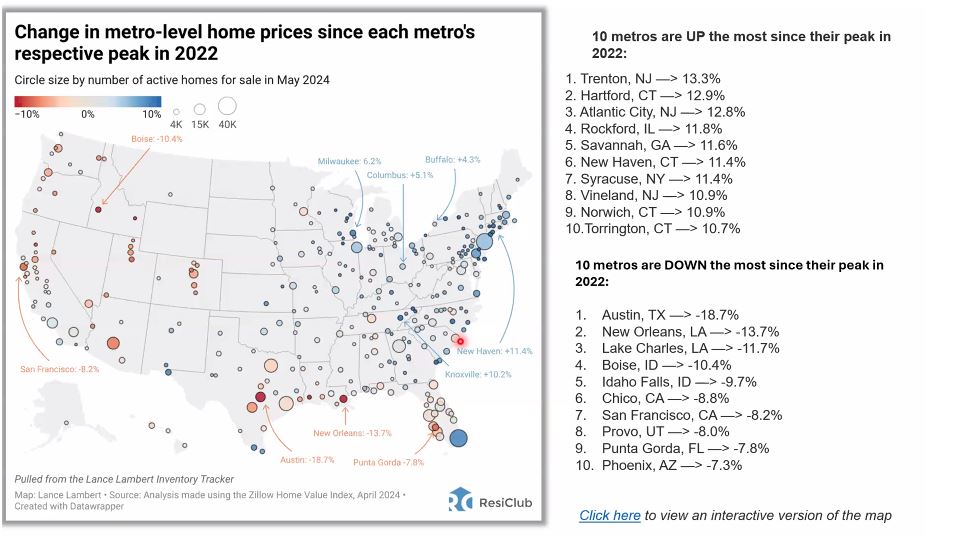

FROM THE NATIONAL NEWS

Change in metro-level home prices in different national markets (see image below).

Please notice that Texas (especially Austin, TX) is leading the nation in the overall drop in home prices, although, based on the graphic, in the DFW area is also affected, along with the rest of Texas market.

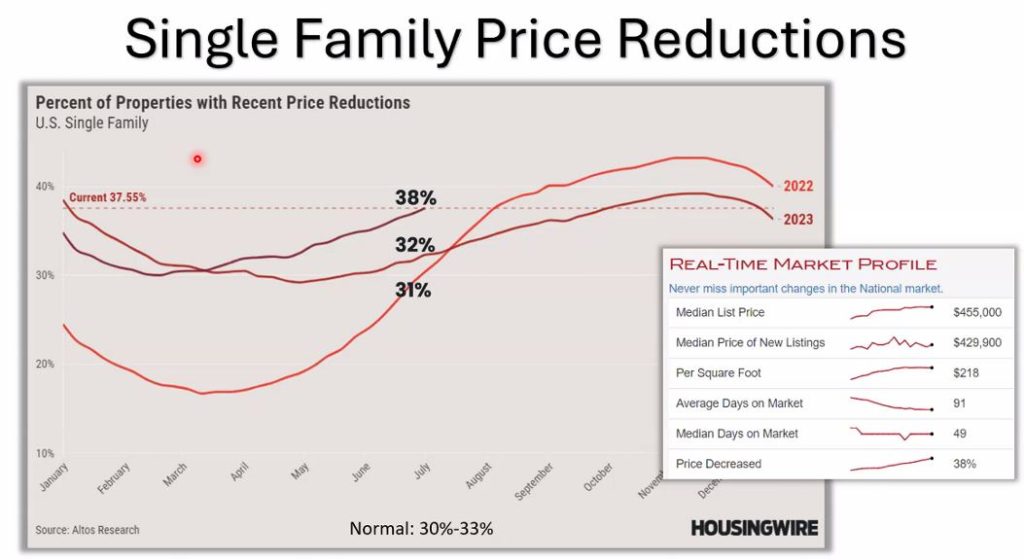

Price reductions across all national markets are outpacing the previous years this Spring-Summer.

Nationwide, the backlog of unsold homes is growing, pushing the prices down.

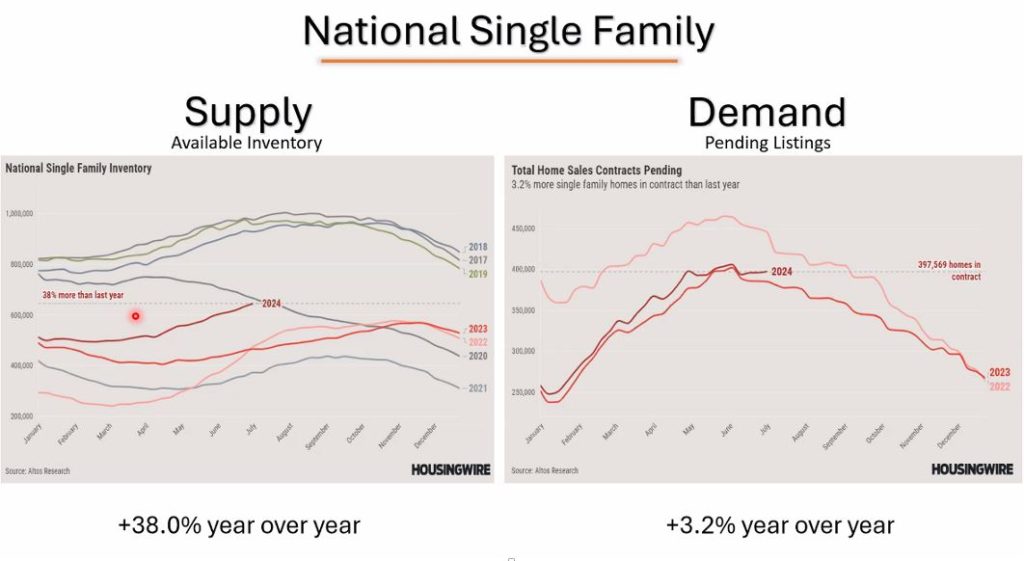

From the graph below, we can see that the supply of homes for sale is higher than in previous years, while the demand for homes for sales is at the 2022 level. Which means that the demand IS high, but the supplier is outgrowing the demand.

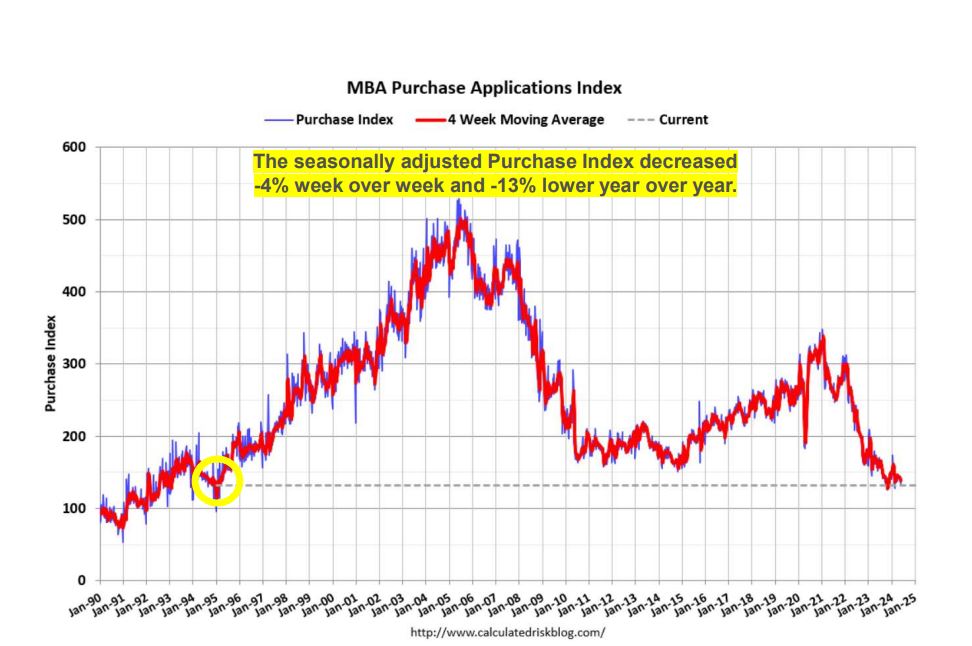

Mortgage applications numbers are some of the lowest in the decade.

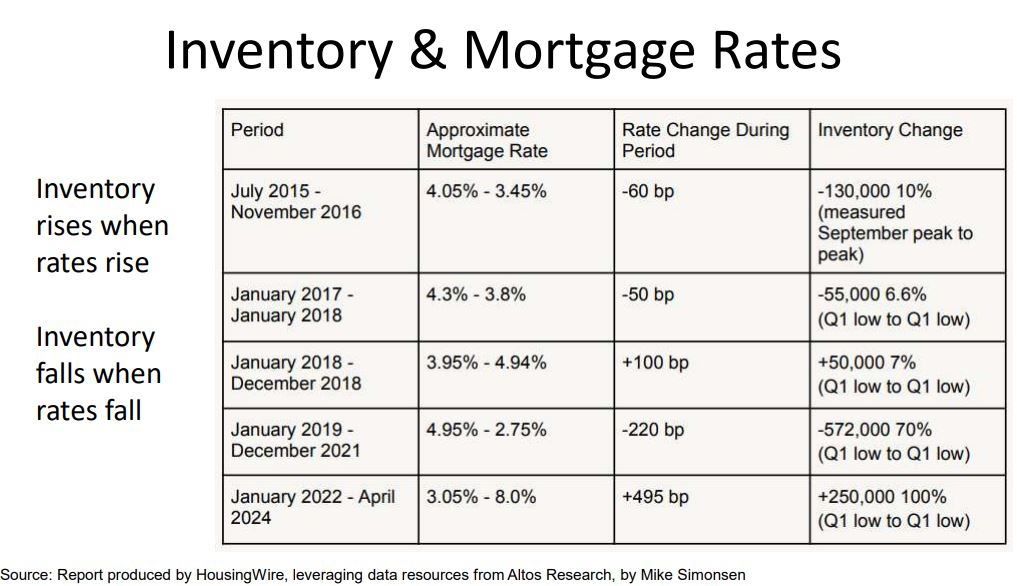

Mortgage rates are currently lower than they were in, say, September-October of 2023, but they are still higher than most home shoppers would like them. High interest rates tend to punish the first-time buyers and tend to benefit the downsizing seniors who can afford to buy wish cash or to put a very sizeable down payment.

What should home buyers and home sellers do in this hanging market? I will be writing more on this topic shortly.

Want to see more stats and trends?

1-2-3-sold advertising opportunities blog buy4cash buyers covid-19 dfw housing market update FICO financial fitness for buyers for homeowners for investors for renters for sellers free materials holidays houses itin knowledge articles legal and financial market updates monthly updates mortgage owner financed houses rent-to-own seller financed houses selling as-is stats stats and trends taxes tips and tricks