MARCH 2023 – DFW HOME MARKET UPDATE

April 8, 2023

April 5, 2023 – by Elena Garrett, Realtor, and 72Sold Area Director

We continue to observe as the trends in the DFW housing market are starting to recover from the shocks of last year’s market changes. Let’s look at the details.

A BRIEF REVIEW OF HOW WE GOT TO WHERE WE ARE NOW: For the past 6 months, the home market in the DFW area has undergone DRASTIC changes. Sizzling-hot seller’s market that we observed in 2021 (and the first half of 2022) was subjected to a significant shock of the sharp increase in interest rates that immediately threw cold water on many buyers’ ability to pay higher monthly payments. The buyers pulled back sharply. As a result, from last Spring to last Christmas holidays home prices declined, on average, between $40,000 and $100,000, depending on the county. After Christmas, this initial shock of the “new normal” in the interest rates started to wear out as both buyers and sellers found new ways to cope with the changes. As a result, by April, buyer activity has increased significantly, and a much higher number of home sellers started to put their homes for sale.

Note: The market price stats shown here show March 2023 closings, which means that the contracts for these homes were written in February.

Check out below the trends that the home market data is showing for the 4 main counties in the DFW area: Dallas County, Collin County, Tarrant County, and Denton County.

ELENA’S PREDICTIONS FOR THE NEXT 4-6 MONTHS:

Since the market indicators have stabilized, it appears inreasingly likely that this year will repeat the “Spring-Summer” price bubble of the previous years. The best times to buy at still-low prices are now expected to be in April. Home prices will likely jump in May. The best times to sell at the highest profit are now expected to be from May to June.

RECOMMENDATIONS:

Home sellers who are trying to sell in the first Spring of 2023 would be advised to keep in mind that higher interest rates mean that the shoppers are currently in the bargain-hunting mood. If your home needs repairs and updates, you can attract bargain-shopping buyers by offering incentives such as interest-rate buydowns and cash concessions. If at all possible, I would recommend that home sellers who are looking to get the highest amount for their property to consider timing the market and selling in May-July and use a program like 72Sold to make sure that their home sells within the first 2-3 days of being on the market. Homes that are not sold within the first week are more likely to be targeted by bargain shoppers who will expect the sellers to provide cash concessions to the buyers.

Home buyers who are trying to buy in April can still benefit from the inventory of homes that are still left over from the slower-than-expected Fall and Winter, in terms of having the power to negotiate lower prices, cash toward closing, or an interest rate buy-down. But closer to May and June the market will most likely heat up (like it does any time the school is out), making it more favorable to the sellers than to the buyers. It would be wise to conclude your home search in April and avoid shopping during the “school is out” period. There are still a few (very few) home builders who offer promotional interest rates that are lower than current mortgage rates. Connect with Elena to get more info on promotional rates that might be available.

To the home sellers: we recommend seriously looking into the 72Sold home selling program which is designed to sell nearly any home within the first 72 hours of it being on the market – and, typically, at a higher price than competing homes. With the 72Sold approach, at the very least the home sellers will get the best chance to sell their homes at the top of today’s market and without having to do any price cuts or concessions.

DFW STATISTICS FOR MARCH 2023

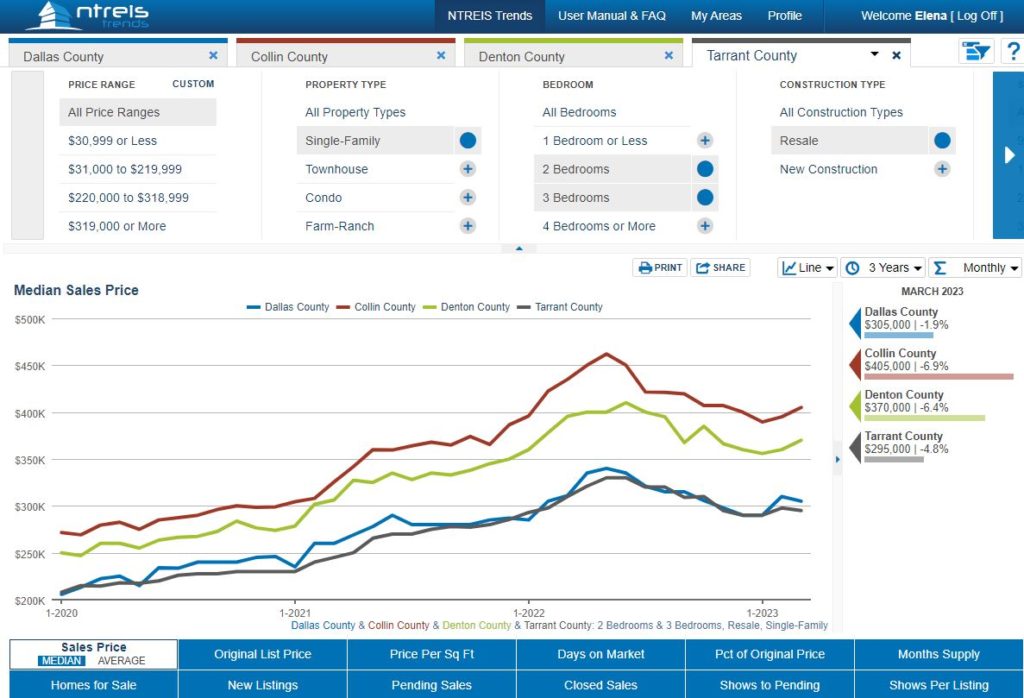

Home Prices Are Still Declining in Some Counties

As we have mentioned in our previous updates, home prices in the DFW area have suffered a decline since May 2022. In Collin County, median home prices (for 3 and 4-bedroom resale homes) have fallen, on average, by $115,000 or 19% since their peak values in May. In Dallas County, homes lost on average $82,000 or 20% of their value so far. In Tarrant County, homes lost on average $40,000 or 11% of their value since May. In Denton County, they lost on average $72,000 or 14% of their value since May.

However, as happens every year, Spring and Summer are the time when more and more buyers start their search for a new home, “heating up” the home prices in the process. In Collin County, the average home price increased by over $15,000 since January, In Dallas county, the median prices went up by $15,000. In Tarrant County, home prices went up on average by $5,000 since January. In Denton County – the median price increased by $14,000 on average.

The increasing home prices benefit the sellers but not the buyers. We are expecting the DFW market to switch from a fairly balanced to a “seller market” during the next 2-3 months. This seasonal trend is similar to the market behavior in the past few years, so from the standpoint of home prices, the market seems to be behaving very predictably at the moment.

Price Cuts Are Becoming Less Common

The graph below shows you how much in terms of percent of the asking price the house sold for. For example, “100%” means the house sold exactly for the same amount as the listing price. “110% SPLP” means the house sold higher than the listing price by 10%, while “90% SPLP” means the house sold for less than the listing price by 10%.

According to this graph, an average home seller ended up selling about at their asking price or very slightly below it. The home sellers in Denton County seem to be leading the market with a typical 100% asking price achieved.

For home shoppers, this graph is bad news. It demonstrates that their chances of getting home sellers to reduce their prices are getting slimmer. For home sellers, this graph is good news because that shows that when priced and marketed well, they should be able to avoid price cuts in the current market. However, as we see, many sellers in Dallas, Collin, and Tarrant counties still had to agree to price reductions. This is likely due to the sellers overestimating the market.

Want to outperform the market? Review the 72Sold program elements that have to do with getting the buyers to pay more than they initially intended.

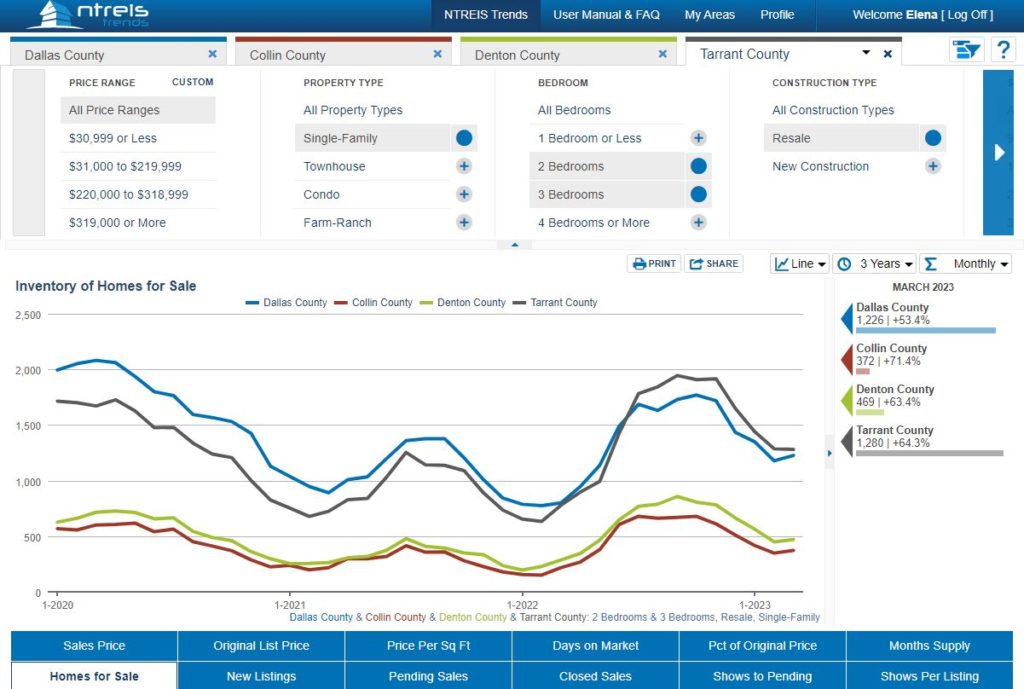

The DFW Home Market Inventory Overload is Slowly Melting Away

Home sellers who started to panic-sell in the Summer and Fall of 2022 created a rare (for our area) “inventory surplus” that depressed prices throughout the DFW. As prices fell, many of the same sellers withdrew their homes from the market during the holiday, “shrinking” the surplus. As we predicted in our previous updates, the arrival of Spring (and the “Spring home shoppers”) started to swing the price pendulum back in the sellers’ favor, prompting more home sellers to put their homes on the market.

We would expect the number of homes for sale to increase steadily in April, May, and June. The inventory increase may dilute and slow down the price increases, as we still have more inventory now than we had for most of 2021, but the interest rates are significantly higher now than they were in 2021.

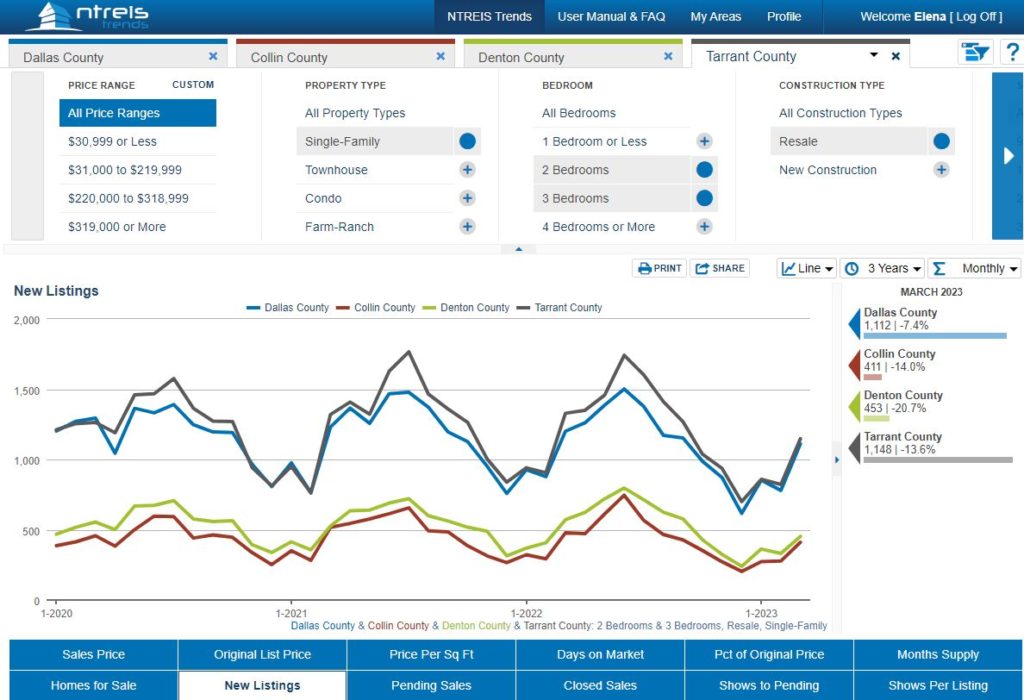

The Number of New Homes Coming on the Market Jumped in March

As expected, many sellers were waiting for the more seller-friendly Spring/Summer months to put their homes on the market. The graph below is showing that the 2023 market is behaving very similarly to the last 2-3 years.

The number of new homes placed for sale in March was highest in Dallas and Tarrant counties and lowest in Collin and Denton counties.

This year’s March trends seem to be in line with the previous years, which may signal that the market is normalizing DESPITE the fact that the interest rates are putting more strain on the buyers.

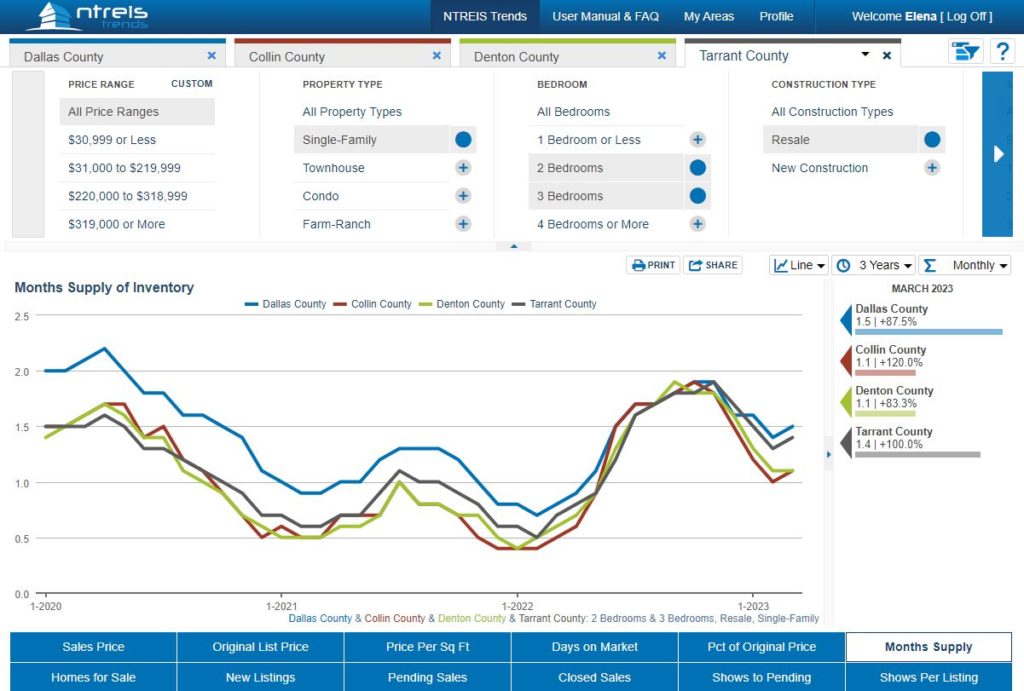

Months of Inventory

Months of inventory measurement is meant to determine how many months’ worth of purchasing activity could the area sustain if no new homes were listed for sale. Usually, any number below 4 months is supposed to indicate a seller market, any number above 4 months is supposed to indicate a buyer market,

As you can see, all four counties are showing nearly identical trends. The months of inventory indicator is currently at about 1-1.5 months of supply for all four counties, compared to 2 months of inventory in November-December 2022. This further indicates that the market is shifting back toward the sellers in 2023.

Days on the Market

Days on the Market is a measurement of how many days the average home takes to go under contract. Long days on the market typically show a slow, saturated, buyer-centric market where the supply exceeds demand. Short days on the market typically mean that the home buyers are buying aggressively, and it typically means that the demand is higher than the supply.

Currently, all 4 counties show that it takes 14-18 days on average to place a home under contract. In comparison, in January of 2023, the average days on market were 25-35 days. For home shoppers, it means that they cannot expect the average house to stay available for sale for more than 1-2 weekends, so they absolutely need to be shopping with their pre-qualification letters in hand to avoid losing their favorite homes to other shoppers.

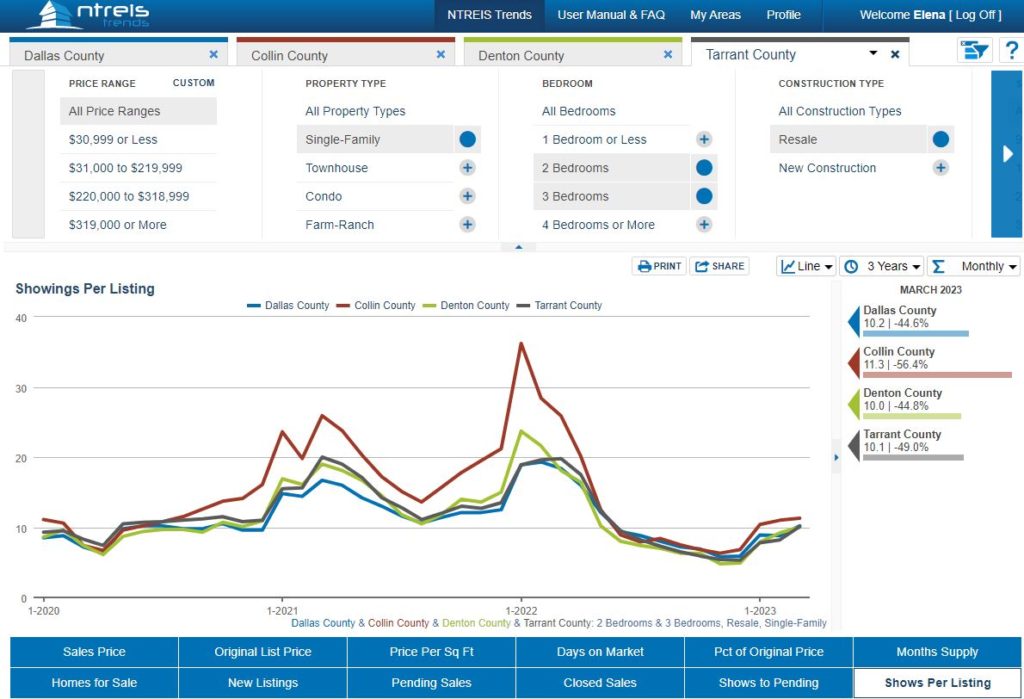

The Number of Buyers Looking at Homes Is Increasing

Speaking of “other home shoppers” (a.k.a competing buyers).

Based on the graph, an average home buyer should expect to compete with at least 10 other shoppers looking at the same home. In comparison, in December, home shoppers were expected to compete with 5-6 other shoppers. So, the competition for homes has doubled since December. Of course, we are still not nearly to the 2022 levels, when an average home had anywhere between 20 and 36 home shoppers all trying to see the house at once. But overall, the trend toward higher competition among home buyers is gaining momentum again.

That is great news for home sellers but bad news for home buyers.

What should home buyers and home sellers do in this changing market? I will be writing more on this topic shortly.

Want to see more stats and trends?

1-2-3-sold advertising opportunities blog buy4cash buyers covid-19 dfw housing market update FICO financial fitness for buyers for homeowners for investors for renters for sellers free materials holidays houses itin knowledge articles legal and financial market updates monthly updates mortgage owner financed houses rent-to-own seller financed houses selling as-is stats stats and trends taxes tips and tricks