MARCH 2024 – NORTH TEXAS HOME MARKET UPDATE

March 31, 2024

March 30, 2024- by Elena Garrett, Realtor, and 72Sold Area Director

Check out below the trends that the home market data is showing for the 4 main counties in the DFW area: Dallas County, Collin County, Tarrant County, and Denton County.

ELENA’S PREDICTIONS FOR THE NEXT 4-6 MONTHS:

Despite still-elevated interest rates, the sale trends in 2024 are currently repeating the traditional “Spring-Summer” price fluctuation of the previous year.

The best times to sell at the highest profit this year is likely going to be MAY due to potentially unpredictable impact of the Realtor commission lawsuit that is guaranteed to add more chaos and uncertainty to the already-unsettled current home market, not to mention the potential national and international Black Swan events that may appear closer to the conclusion of the Election Campaign this year.

The best time to buy the house in 2024 will be April-May, due to the same lawsuit and the same potential issues that the election environment might bring unexpectedly.

Although the Fed keeps promising the drop the interest rates (and keeps breaking these promises), given the overall landscape of uncertainty and unfolding legal changes with the buyers’ agents, after August (once the kids return to school), we would expect a pretty steep decline in prices for the rest of the year.

RECOMMENDATIONS:

Home sellers who are trying to sell this year are advised to keep in mind that still-high interest rates mean that the shoppers are currently in the bargain-hunting mood. If your home needs repairs and updates, you can attract bargain-shopping buyers by offering incentives such as interest-rate buydowns and cash concessions. If at all possible, I would recommend that home sellers who are looking to get the highest amount for their property to consider timing the market and selling in June at the latest, and use a program like 72Sold to make sure that their home sells within the first 2-3 days of being on the market.

Homes that are NOT sold within the first week are more likely to be targeted by bargain shoppers who will expect the sellers to provide cash concessions to the buyers.

Home buyers who are trying to buy in this year will have additional hurdles to overcome as the Realtors who typically represent buyers may now ask the buyers to guarantee payment of their commission, adding another huge expense to the already high cost of buying a home or shop for homes without the advice of an experienced professional.

As the interest rates remain close to 6%-7%APR, it is strongly recommended that home buyers who plan to use a loan to buy their home made asked their lender for ways to buy down the interest rates, temporarily or permanently. For home buyers on a tight budget, consider looking at homes that have been on the market for over 60 days, as those homes are more likely to provide price concessions or funds to help the buyers with the interest rate buydowns.

To the home sellers: we recommend seriously looking into the 72Sold home selling program which is designed to sell nearly any home within the first 72 hours of it being on the market – and, typically, at a higher price than competing homes. With the 72Sold approach, at the very least the home sellers will get the best chance to sell their homes at the top of today’s market and without having to do any price cuts or concessions.

DFW STATISTICS FOR MARCH 2024

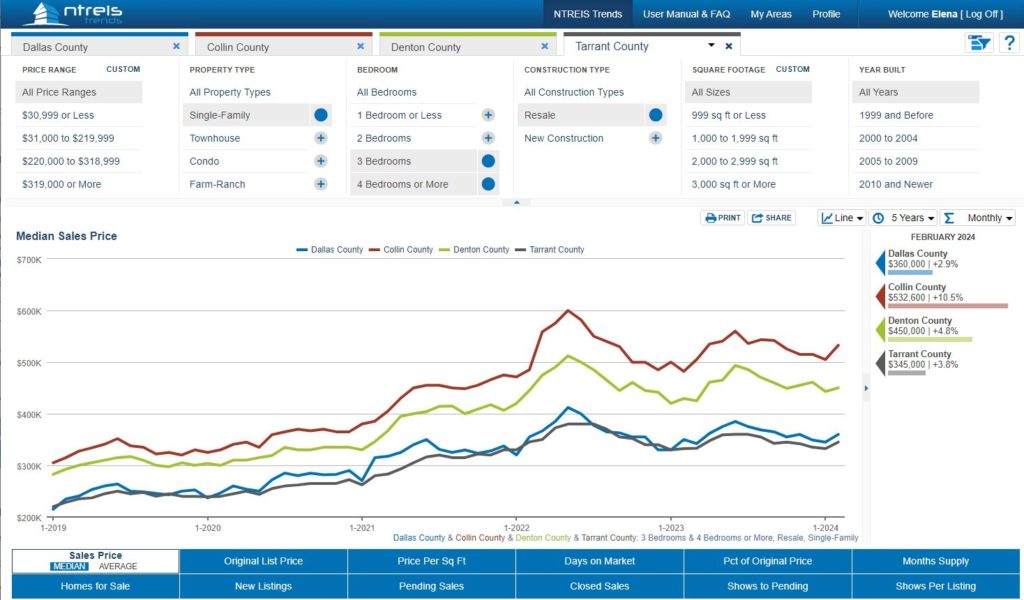

Home Prices Jump

Home prices in the DFW were down in November and December due to the holidays, but they have jumped with the arrival of warmer weather. All counties under review (Dallas, Collin, Tarrant, Denton counties) are showing similar signs of home prices increasing, with Collin county showing the most dramatic price inreasses.

The home prices are still below their April 2022 maximum values, but there are strong indications that home prices will go up significantly by Summer, based on the strong price growth right after the 1st of the year.

Bidding Wars Are Uncommon

The graph below shows you how much in terms of percent of the asking price the house sold for. For example, “100%” means the house sold exactly for the same amount as the listing price. “110% SPLP” means the house sold higher than the listing price by 10%, while “90% SPLP” means the house sold for less than the listing price by 10%.

According to this graph, an average home seller ended up selling about at about 97.5% of their asking price in all counties. This means that, currently, there

For home shoppers, this graph is good news. It demonstrates that their chances of getting home sellers to reduce their prices is there. For home sellers, this graph is bad news news because that shows that most homes are not getting multiple offers (yet), and therefore some homes have to accept offers that are below their hoped-for price.

Want to outperform the market? Review the 72Sold program elements that have to do with getting the buyers to pay more than they initially intended.

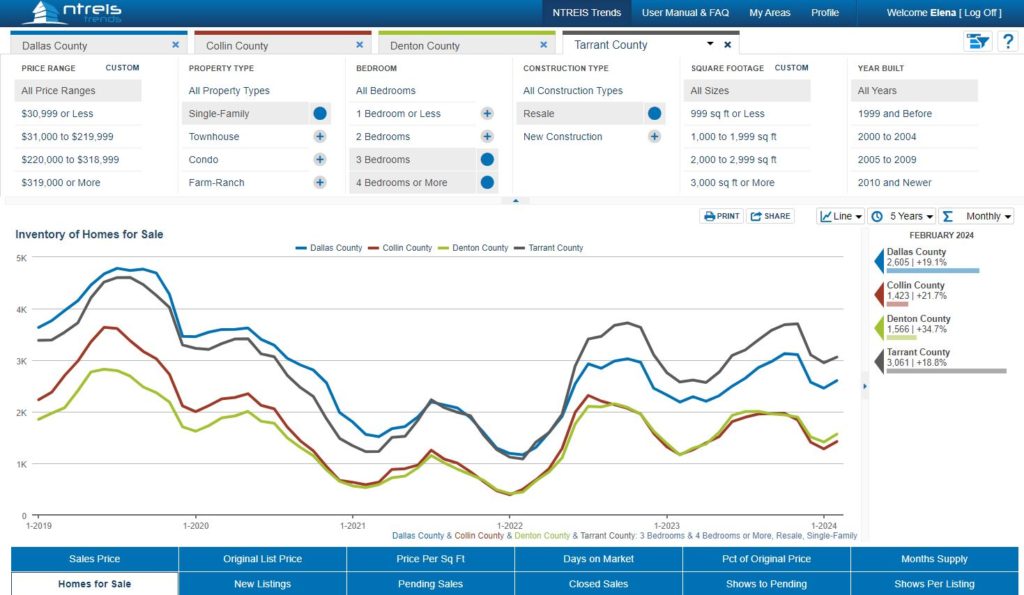

The DFW Overall Home Market Inventory Is Steady

The inventory of unsold homes dropped during the holidays as home sellers took their homes off market to spend time with their families. But after the holidays we can see that the inventory started to grow again. Currently, it appears that the number of unsold homes will likely reach the levels of the previous year.

The higher is the inventory (selection) of available homes, the more the market typically swings toward the buyers, and the more sellers have to compete with each other on price, improvements, and, potentially, monetary concessions to buy down interest rates or help the buyers with the downpayments.

We will continue to monitor the number of available homes to see how they affect home prices.

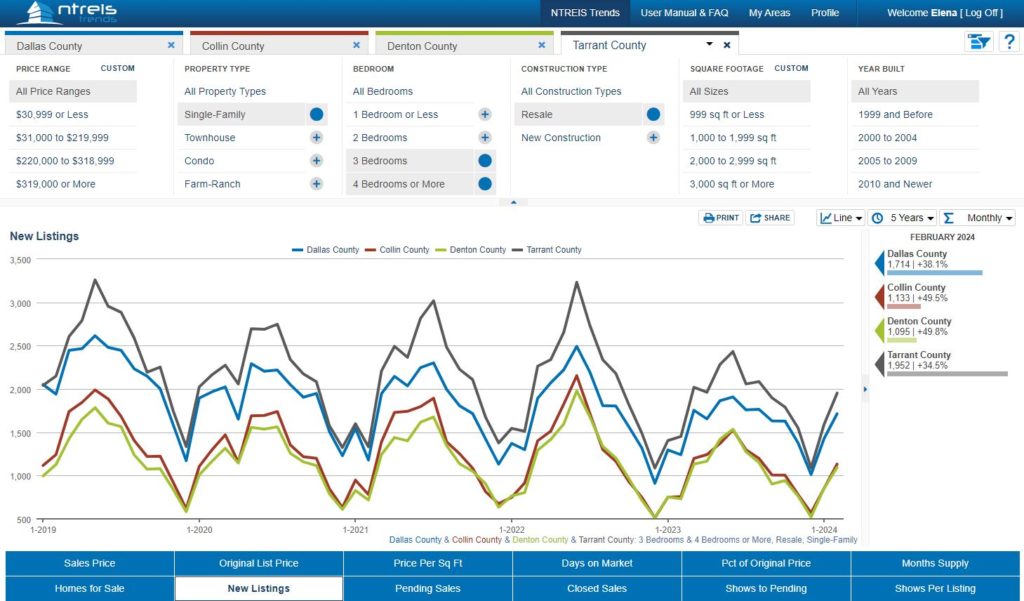

The Number of New Homes Coming on the Market Jumped After the 1st of the Year

As expected, many sellers were waiting for the holidays to end to put their homes back on the market after taking a time off at the end of the previous year.

The overall number of new homes placed for sale in February (the last month for which we have the data at this time) was highest in Tarrant and Dallas counties, and lowest in Denton county.

This year’s February trends seem to be in line with the previous years, which may serve as yet another signal that the market is normalizing DESPITE the fact that the interest rates are continuing to put strain on the buyers’ budgets.

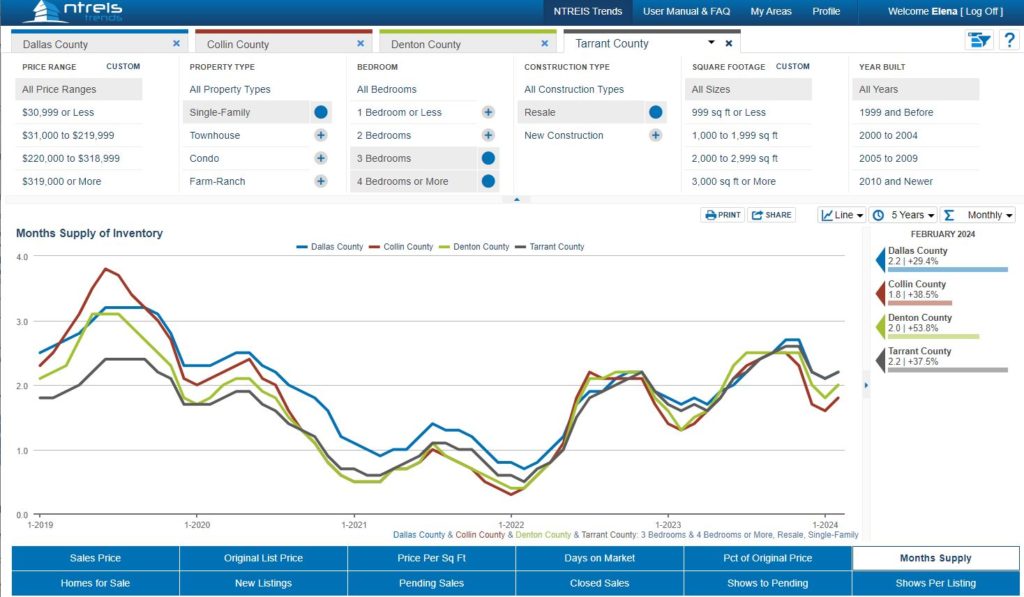

Months of Inventory

Months of inventory measurement is meant to determine how many months’ worth of purchasing activity could the area sustain if no new homes were listed for sale. Usually, any number below 4 months is supposed to indicate a seller market, any number above 4 months is supposed to indicate a buyer market,

As you can see, all four counties are showing nearly identical trends. The months of inventory indicator is currently at about 1.8 – 2.2 months of supply for all four counties, making this season a seller market despite increasing inventory.

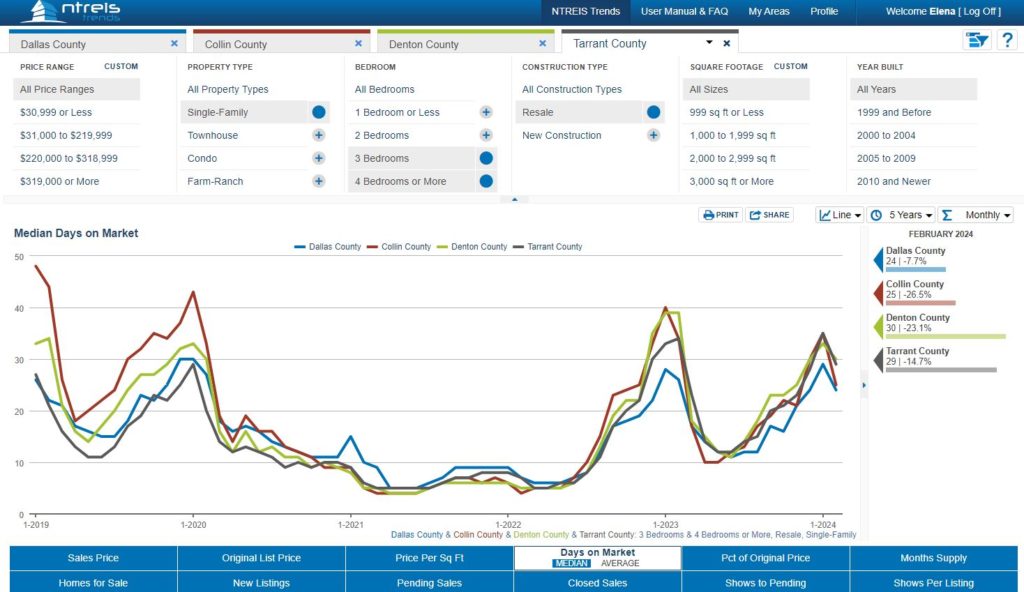

Days on the Market

Days on the Market is a measurement of how many days the average home takes to go under contract. Long days on the market typically show a slow, saturated, buyer-centric market where the supply exceeds demand. Short days on the market typically mean that the home buyers are buying aggressively, and it typically means that the demand is higher than the supply.

Currently, all 4 counties show that it takes 25-30 days on average to place a home under contract. This is still a long time to sell in comparison, for example, to May of 2022, when the average days on market were 5-7 days. For home shoppers, it means that they can expect the average house to stay available for sale for more than 3-4 weekends, giving them an additional negotiating power when asking for price concessions or repairs/updates.

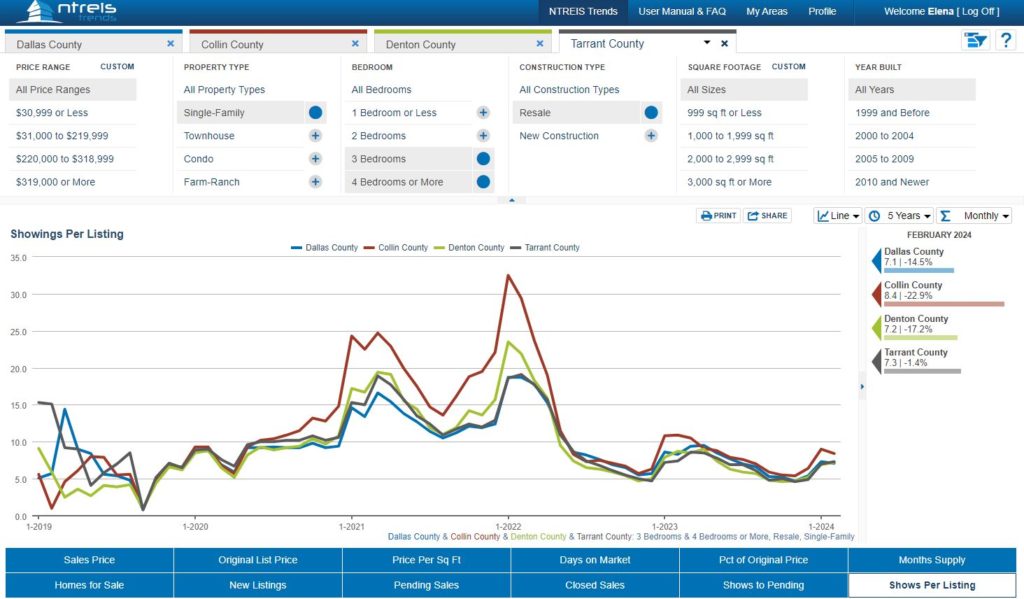

The Number of Buyers Looking at Homes Is Still Low

Speaking of “other home shoppers” (a.k.a competing buyers).

Based on the graph, an average home buyer should expect to compete with at least 6-7 other shoppers looking at the same home. This seems to be in line with the previous year numbers of home shoppers per house. This means that the number of motivated home shoppers has remained relatively flat since last year. This should serve as a caution to the home sellers not to price their homes too aggressively, as the shoppers are not experiencing a high-pressure sale environment overall, unless the seller is utilizing more advanced techniques to prompt home buyers to buy faster and at a (hopefully) higher price.

What should home buyers and home sellers do in this changing market? I will be writing more on this topic shortly.

Want to see more stats and trends?

1-2-3-sold advertising opportunities blog buy4cash buyers covid-19 dfw housing market update FICO financial fitness for buyers for homeowners for investors for renters for sellers free materials holidays houses itin knowledge articles legal and financial market updates monthly updates mortgage owner financed houses rent-to-own seller financed houses selling as-is stats stats and trends taxes tips and tricks